Native Americans and the New Nation

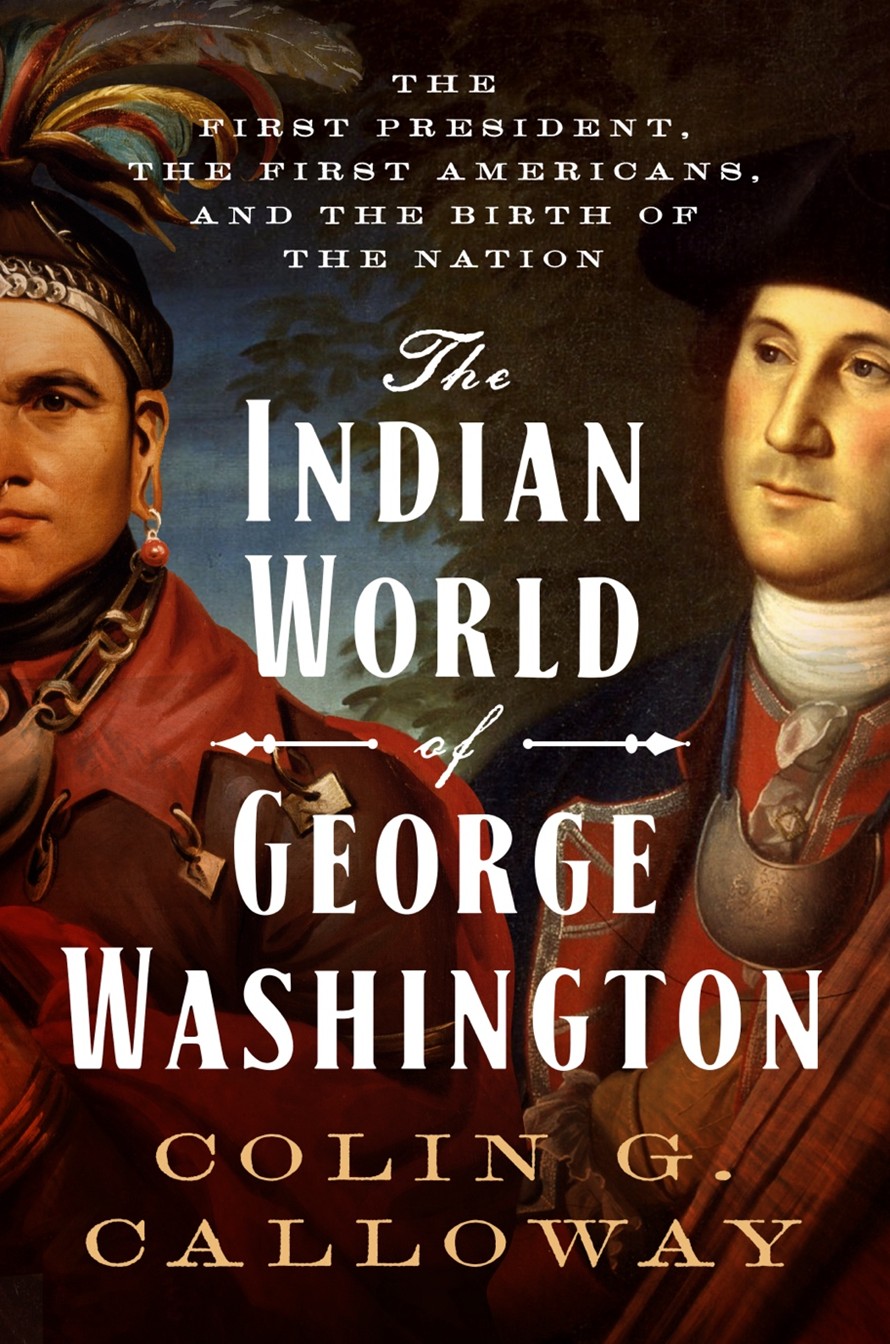

Native Americans are likely to be sidelined in the 250th anniversary of the birth of the United States. In this talk, expert Colin Calloway will restore them to their central role in the coming and course of the Revolution, in the presidency of George Washington, and in the development of the new nation. He will be presenting remote.

Native Americans are likely to be sidelined in the 250th anniversary of the birth of the United States. In this talk, expert Colin Calloway will restore them to their central role in the coming and course of the Revolution, in the presidency of George Washington, and in the development of the new nation. He will be presenting remote.

SKU: WI26SPSPE299AR

April 15, 2026, 11:00 am to 12:00 pm

Building: Live Oak Hall

Room: Live Oak Hall